What's New - Vol. 1

Writing is a good way to think and organize random thoughts. Mastodon and twitter are good ways to share random thoughts, but not suitable to search myself in the future. Thus, I decided to create a series named What's New, and post them weekly, monthly, or maybe yearly.

The information here is probably useless, as it is created to help me orgnaize my ideas. However, I would be very glad if it helps any one.

News

Economy

The economy was interesting this week. Nikkei 225 fell about 10% Monday and rose about 10% Tuesday. And S&P 500 fell a lot too. It was said to be caused by Japanese Yen carry trades, which I was not familiar at all. I began learning investment recently. There are lots of topics to learn.

Interestingly, Chinese stock market is not affected by the global market at all. Foreign investors stay cautious about china stocks, as UBS report shows. There are also no good policy released to boost domestic demand. No signal of recovery yet.

Fed is likely to reduce the interest rate. It may be a suitable time to purchase some bonds.

Business

It is said that TEMU exploited sellers. It received fees from buyers and didn't pay enough money to sellers. Such company is dirty. There is some news that PDD exploited its employees in China. I will avoid using products created by such companies.

Serveral companies conducted layoff recently. Looks like the economy grew worse.

My Activies

Creating a Blog Theme

I began to create a zola theme. Though there are already lots of themes to pick, it was very painful for me when I wanted to do some customization myself. For example, I may love one theme but I want a TOC sidebar. It was easier to control more things with a own theme.

I wanted to use pandoc in the beginning, as it provides a template

engine too, and it is kind of more future proof. However, I didn't know

how to generate RSS feeds by it. Thus, pick zola in the end.

When developing the theme, I found that a simple design with limited CSS stylesheets is beautiful enough. It also helps reduce my migration feature if there is any better static site generator in the future.

Learning Investment

I was reading Expected Returns: An Investor's Guide To Harvesting Market Rewards recently.

As a value investor, I believe that valuable companies will have larger market cap in a long term. However, it is hard to deny that economy will affect the value of companies dramatically. During economy recession, market cap of most companies will decrease. I don't think I can hold my positions with full confidence in that period. Thus, it is necessary to learn how to adjust postions.

When GDP grows, stocks will have great growth. When it decrease, it will be better to hold bonds. Momentum strategy, bonds, and CTA work better during recession.

During high inflation, long term bonds will cause loss drastically. We had seen it this year. TIP, commodities, and real estate work well at that time. During deflation, most assets perform poorly. Only bonds work well.

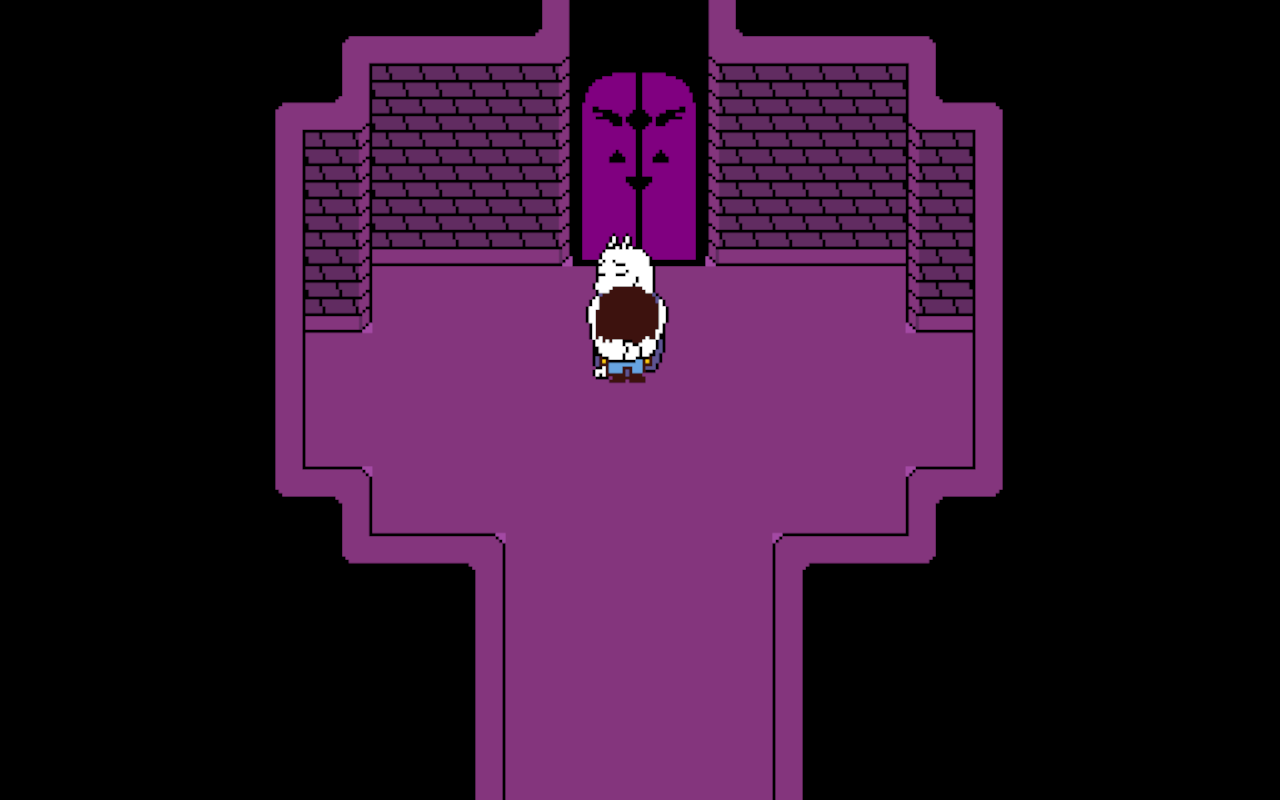

Undertale

I played undertale recently. I may feel surprised if I can play it in 2006 . There are already lots of posts about it. So no much suprise now. However, TORIEL is depicted very well. I felt sad that she didn't receive my call any way after I leaved.